About the Program

Envestnet Institute On Campus (EIOC) is a program designed to develop a collaborative relationship between academia and industry-leading firms in the wealth and asset management space. Its purpose is to provide a mechanism by which motivated students are offered a training regimen specifically designed to bridge the gap between the knowledge presented in academia and the application of this knowledge in the world of wealth and asset management. Additionally, the program aims to create an ecosystem in which industry hiring managers are able to identify potential employees who are well qualified for a career in the financial services industry.

Program Highlights

Industry-sponsored program with no cost to universities or students. Each university is allotted up to 25 seats in the course on a per semester basis. Following completion of the program, job and internship search support available through the Resume Hub. Optional learning modules and webcasts are available in addition to the required course content.

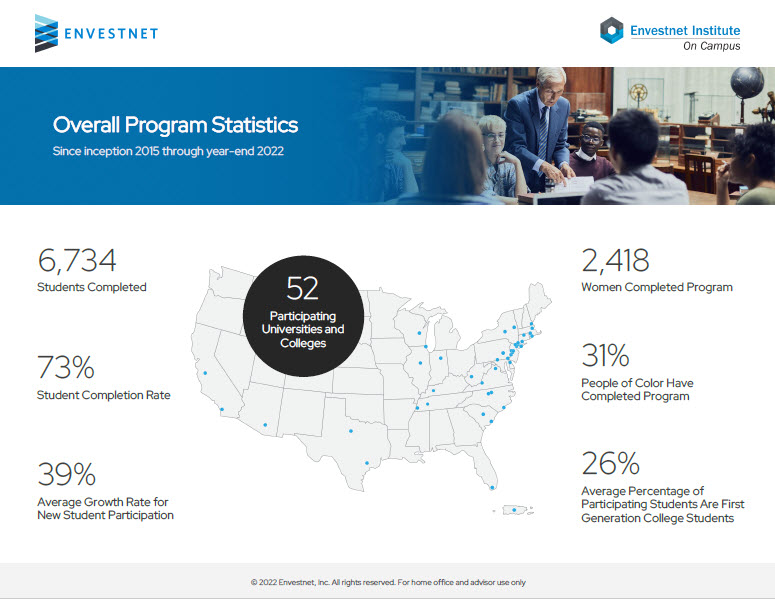

Program Statistics

(as of year’s end 2022)

Participating Universities

Program Syllabus

EIOC-101: Basics of Investing This class covers portfolio construction to meet client objectives. It includes an in-depth look at developing an investment strategy and the concepts of strategic and tactical allocation, active and passive management, top-down and bottom-up approaches to security selection, fundamental versus technical analysis, asset diversification, and risk mitigation. Estimated time to complete, with test: 50 minutes

EIOC-102: Evolution of the Managed Solutions Industry One of the most popular in-person classes, this includes a comprehensive review of each managed investment solution: how it began, how it operates, why it is popular, and its future growth potential. A case study in unified managed accounts highlights construction and the use of an overlay manager. Estimated time to complete, with test: one (1) hour

EIOC-200: The Sales Process and Client Interview How do investors transition from prospects to clients? This class presents best practices for building successful advisor-client relationships, including client profiling, addressing investment risks and rewards, goal setting, and creating investment policy statements. Two case studies are included, covering the challenges of saving for children’s college educations and dealing with the complexities of Social Security distributions. Estimated time to complete, with test: one (1) hour

EIOC-201: Baby Boomer Investing With more than 76 million American baby boomers in the population today, the financial services industry remains challenged in terms of better serving the needs of this segment of investors. This class focuses on what today’s investment professionals need to know about baby boomers to help them best prepare for the stages of retirement. Estimated time to complete, with test: 45 minutes

EIOC-202: Technology to Service and Support Managed Solutions This class is a comprehensive look at the technology today’s advisor needs to manage his or her practice. It covers the evolution of various advisor technologies, and the different tools and/or systems that comprise the advisor’s platform to enable prospecting, client profiling, and client relationship management. Estimated time to complete, with test: 50 minutes

EIOC-203: The Unified Managed Household And What it Means to the Financial Advisory Business Technology is evolving quickly to keep up with the demand for comprehensive advice. Rather than focus on the product sale, an advisor needs a holistic view of all accounts and registrations associated with a household in order to formulate an effective investment plan. This may involve applying overlay technologies that are capable of coordinating all accounts, regardless of where assets are held. The technology chosen is especially critical in the distribution phase, when clients are dependent on a predictable stream of income. This class explores these technologies and how they will continue to evolve. Estimated time to complete, with test: 45 minutes